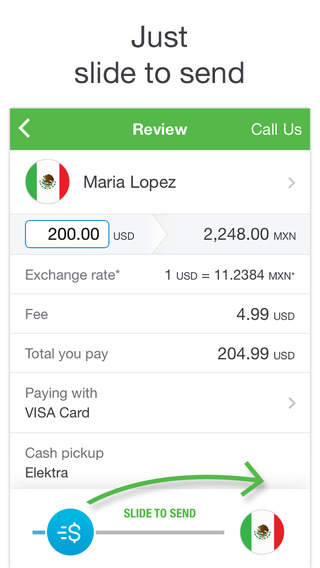

When it comes to money-transfer services, most of us, if not all, are interested in making the process as effortless and speedy as possible. Xoom has a convenient calculator you can use to see the fees for different country combinations and payment methods. This data stands as of December 1, 2020.Īs you can see, you may be able to get away with paying absolutely no Xoom transfer fees in some cases, usually when sending more money and paying with your bank account. In comparison, using a credit or debit card would incur a $3.99 fee to send money to Mexico with Xoom and a $30.49 fee to send money to India with Xoom. If you decide to send $1,000, for example, and use your PayPal balance or bank account to pay for the transfer, the fee will be $0. To illustrate, there’s a huge difference in fees when sending money to a country like Mexico and a country like India. If you want to cut your costs, you should to make sure the recipient receives the money deposited into their bank account.Įxample: Sending Money to Mexico and India The fees are (unsurprisingly) higher when sending cash.

Out of 21,634 reviews (December 2020), it scores a solid 4.4, with 87% of clients reviewing it as Excellent. It has gained the trust of many customers so far, and its Trustpilot reviews confirm this. Another feature that makes Xoom stand out is the excellent transfer speed.Īs far as user experience goes, most users say that they’re satisfied, so we do believe that Xoom is a rather good money-transfer service. On top of that, you can easily send money with Xoom on the go through the convenient mobile app.

One of the biggest benefits of Xoom is its coverage - it allows users to send money to more than 150 countries worldwide. People who use PayPal will find themselves in familiar waters, since both services are extremely similar.

#XOOM CURRENCY RATES VERIFICATION#

The transfer would take between 2 -3 days and you may need to provide additional verification for this amount.We found Xoom to be quite easy to navigate, which is probably why it is so appealing to users.

#XOOM CURRENCY RATES PLUS#

For a debit or credit card, you would incur a fee of $601.49 plus the exchange rate markup. If you are sending money via debit or credit card, you should expect a fee of $30.49 plus the exchange rate markup Xoom adds.Īgain, Xoom charges no fees for bank transfer, but that’s not to say that you may incur expensive charges directly from your bank. Xoom’s fees actually go down for larger transactions if you are using a bank transfer (although you may incur additional fees from your bank, and the recipient may incur fees from their bank on the other end).

Unfortunately, Xoom’s exchange rate margins are not clear, but you should expect to pay a markup between 2 – 3% on the mid-market rate. To send this amount to Spain, you should expect to pay a fee of $4.99 for a transfer via your bank account, or $6.49 using your debit or credit card.

0 kommentar(er)

0 kommentar(er)